dog health pet insurance simplified for real savings

Why it matters to your budget - and your dog

Your dog gets care fast, you avoid a gut-punch bill, and future choices feel easier. Result: treatment decisions based on health, not panic. Bonus: predictable costs can beat one giant emergency invoice.

How coverage usually works

You pay a monthly premium. When your dog needs care, you visit any vet, pay the bill, submit a claim, and get reimbursed based on your plan's deductible, percentage, and limit. Short story: the math decides the savings; the policy decides the speed.

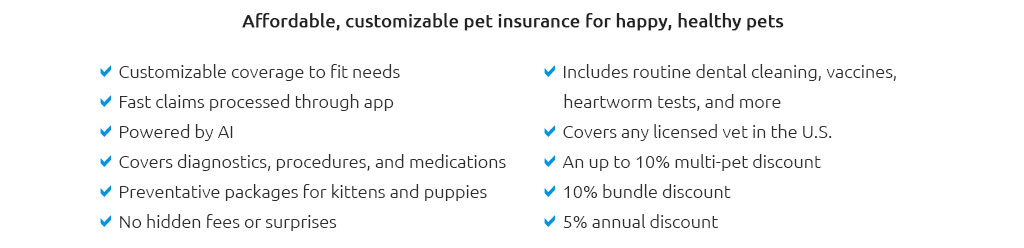

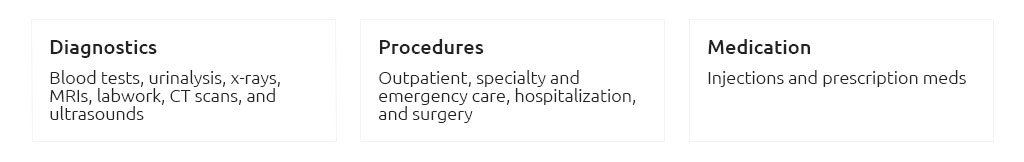

Plan types at a glance

- Accident-only: Cheaper, focuses on injuries like broken bones or foreign-body ingestion.

- Accident + illness: Broader protection for things like ear infections, GI issues, cancer.

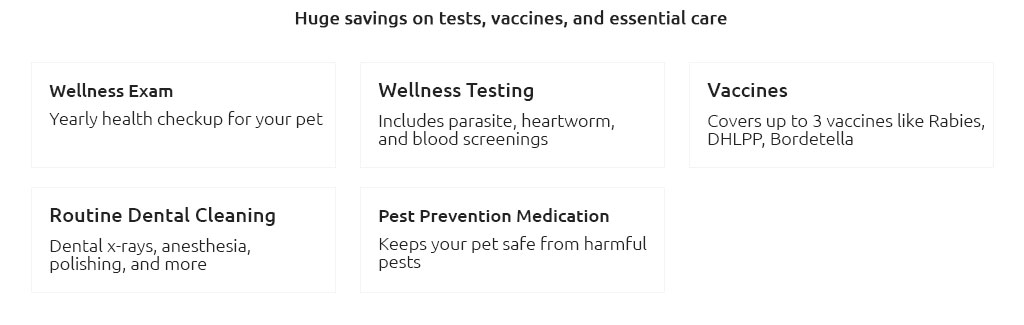

- Wellness add-ons: Routine care (vaccines, dental cleanings) if you want steadier budgeting.

Real-world moment

My pup started limping after a weekend hike. I snapped a photo of the invoice in the clinic parking lot, submitted the claim in minutes, and the reimbursement landed a few days later - less stress, more walk-time.

What drives price - and your savings

- Dog factors: age, breed, and location shift risk and premiums.

- Deductible: higher deductible usually means lower monthly cost, but more out-of-pocket before coverage kicks in.

- Reimbursement rate: 70 - 90% is common; higher pays more per claim but costs more monthly.

- Annual limit: bigger limits protect against big years.

- Waiting periods: coverage starts after these windows; plan them around upcoming checkups.

Realistic check: pre-existing conditions are typically not covered. Enroll while your dog is healthy to protect the future version of you.

Quick compare in explorer-mode

- List your must-covers: emergency surgery, chronic conditions, hereditary issues.

- Pick a comfort-number for monthly spend; then test deductibles until the math fits.

- Scan exclusions; stop if something critical to your breed is missing.

- Check claim turnaround time - days matter.

- Look for direct pay or fast reimbursement; it smooths cash flow.

Terms decoded fast

- Deductible: what you pay first each year (or per condition) before reimbursement.

- Reimbursement%: portion the insurer pays after the deductible.

- Copay: your share after reimbursement.

- Annual/incident limit: the cap the plan will pay.

- Waiting period: time after signup before certain claims are eligible.

Common exclusions

- Pre-existing conditions

- Breeding costs

- Cosmetic or non-essential procedures

- Some dental unless caused by accident or with a wellness add-on

Tips that stack real savings

- Start early: younger enrollment = fewer exclusions and better rates.

- Right-size the deductible: if you can handle small bills, raise it to cut premiums.

- Bundle smartly: wellness add-ons only if you'll actually use them.

- Keep records: itemized invoices and notes speed approvals.

- Reassess yearly: switch limits as your dog ages and risks shift.

The payoff

Result: steadier budgeting, faster green-light on treatment, and fewer "do we wait?" moments. You're not buying perfection - you're buying freedom to choose care without derailing your savings.